The Haunting 2020 is Finally Gone:

With the pandemic of Covid-19 haunting the whole global community, 2020 has proved to be an exhausting year with a projection of fear, uncertainty, instability, and chaos. Many employees lost their jobs and many businesses were forced to shut down especially the small businesses. So overall the pandemic of Covid-19 brought a lot of disruption and turmoil in human lives. With the arrival of 2021, a new resolution is set into every mind to fight this pandemic and prove human surviving skills. Moreover, it is intended to bring new better strategies for plans in business management to compensate for the loss of 2020.

The New Scope of Online Businesses:

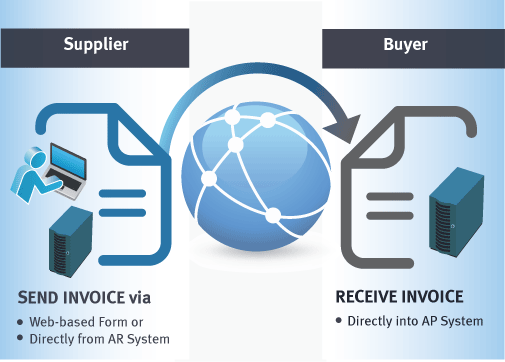

With increased social distancing and more scope of online businesses, electronic invoices are getting tremendously popular among mankind who always devise new techniques when any calamity falls.

Many real-time retail businesses have been shifted to online businesses to deal with the pandemic of Covid-19 and thus this has become an urgent need to know what an Electronic Invoice is

Cloud Software and Increasing Popularity:

Cloud-based software is becoming the urgent need of your business as it is also called web-based software. Online software or web-based software is the same thing depending upon the internet cloud and a good and reliable internet connection. The cloud-based software is hailing the market due to its outstanding features of global accessibility. With internet connectivity, you can access your business data from any location and need not be present at the premises of your business location.

Data encryption improves the security and protection of data with the help of scrupulous algorithms (encoding and decoding). Your online business can only get promoted if you avail yourself a cloud-based software with the basic feature of the Electronic Invoice. So understanding an electronic invoice is of utmost importance and significance.

What is meant by an Electronic Invoice?

The standard form of an invoice has been an invoice printed on paper along with its submission at the point of any transaction or business services rendered to customers. With the transformation of the world due to the pandemic of Covid-19 more and more businesses are converting to online systems with the concept of e-invoices.

Although many electronic devices may confuse with a scanned form or copy of the standard paper invoice, the standards may vary from country to country. Scanned or photocopied invoices are not termed e-invoices. The standards for electronic invoices originate from the Electronic Data Interchange standards. It lists the rules and regulations for how an e-invoice should be created, generated, and then shared.

Definition of Electronic Invoice:

In the new decade of 2021, you need to adopt new ways and principles to deal with the pandemic of Covid-19, and Electronic Invoice generation is one of them. Now the paper invoices time is given a goodbye handshake and here comes the new concept of electronically transmitted web-based invoices that are created by the online software. Electronic Invoicing is a form of electronic billing to ensure the trading requirements between the customers and suppliers to present the online transactional documents.

Electronic Formats:

The standards vary for the electronic invoices from country to country depending upon the Electronic Data Interchange standards. EDI FACT is an instance of such a standard that the United Nations has designed. It entails the details such as codes for header information and the transmission of specific line items or products.

Saudi Arabia introduces Electronic Invoicing:

The (GAZT) of Saudi Arabia also called as General Authority of Zakat and Tax has recently published the laws and regulations on the implementation of electronic invoicing (e-invoicing). All the businesses in the vicinity of Saudi Arabia are given 12 months period to implement the relevant technology and get ready for generation/issuance and storage of e-invoices in acceptable formats.

Purpose of Implementing the Electronic Invoice:

The main aim of GAZT in the latest announcement of practicing electronic invoices is to limit the shadow economy and ensure the promotion of fair competition as well as consumer protection and prohibiting commercial and tax fraud.

What are the Technical Requirements of Electronic Invoice

As per the e-invoicing regulations, there are certain preliminary requirements for the technology listed below:

The ability to connect with the external systems using Application Programming Interface (API).

The extreme compatibility with all the cybersecurity laws implemented in Saudi Arabia.

The software solution must allow the detection of data intervention or manipulation.

Internet connectivity with stable speed.

Web browser with reliable services.

Conclusion

By allowing your business to benefit from SMACC software you can not only implement the electronic invoicing but also take care of payable taxes. SMACC is robustly built to ensure the best customer services to compensate for the deteriorating economy in 2020 and help you emerge to a new horizon of success in 2021 with your online business.

Also read about:

Finding the Best Solution For Your Carpet

Three Popular VMware Courses That You Must Take Before Your VMware 3V0 643 Exam

Basic Guide To OgyMogy Parental Control App for Android